2012 - SuperCommerce Series

Top Mobile Commerce News

Search, Social or SuperCommerce?

The key to commerce shall be the seamless completion of the value and convenience chain for consumers and merchants alike.

How may Google, Facebook and First Data disrupt Daily Deals? Will EVOLUTION lead

to REVOLUTION? How about M&A?

Daily Deals Manifest Destiny

Can one live on deals alone?

Tour D' Mobile Payments

PayPal, Google Wallet, ISIS, Square & more. What are the barriers to adoption and how they may be overcome?

AUG

SEPT

SEPT

The Future of Money

Where will payments be in 2020? Will mobile over take cards & cash? Learn how a 'Secure, Social & Rewarding' wallet will disrupt it all?

Bridging the POS GAP

NFC is Tortoise and the 2D Bar Code is the

hare. Retailers, simplify the myriad of choices!

Learn how DISRUPTION is RIPE for 2013!

OCT

OCT

Greed is NOT GOOD!

Cause Commerce IS!

Cause Commerce can set you apart! Learn what it is, why it will soon be, non-optional, and how it will add to your Social Brand.

NOV

Loyalty LIKE Never Before!

NOV

Companies and leaders, to remain relevant and profitable, must embrace innovation or risk becoming irrelevant or extinct.

Top 5 Killers of Innovation!

HDTV - High Def. Total Vision Where are your Blind Spots?

Connect the dots! See the big picture!

If your Mobile Strategy is unclear, you may be

missing key pieces. Get a holistic perspective.

AUG

DEC

TM

Articles by Mobile Wallet Media

2013 Series

The 'Disruptive Innovation Meteor' named MOBILE has struck the world's of retail payments, banking and marketing. Firms wanting to survive, compete and win in this new environment must adapt by embracing disruptive innovation or risk becoming irrelevant or extinct. Read story

IF YOU FORGOT WHAT INNOVATION LOOKS LIKE

WATCH IPHONE'S FIRST COMMERCIAL BELOW . . .

Disruptive Innovation and Dysfunctional Dinosaurs

image source: abcnews.go.com

The convergence of Social & Rewards is here!

Learn how Top of Mind & Automation will rule! Maximize, Mobilize & Unify Ads & ROI!

By Randy Smith,

Mobile Wallet Media

July 8, 2013

Can Clinkle iron out it's wrinkles? Will the Winklevoss's venture lead to a quick flip or flop?

Clinkle, a mobile payment/wallet startup launched in 2011, announced last week it secured a record 25 million of seed capital. Is Clinkle the next Square for mobile wallets? So how are these Stanford, smarty pants, students going to rock the world of mobile payments? They have a dog whistle and some solid graphic designers. Sorry I could not resist calling their very cool and genius invention a dog whistle, but it really is. Question is, did they test it out on dogs to see if the noise will drive them crazy? Will their inaudible message be heard round the world or even the U.S.? Hmm, maybe. Continue

By Randy Smith,

Mobile Wallet Media

July 31, 2013

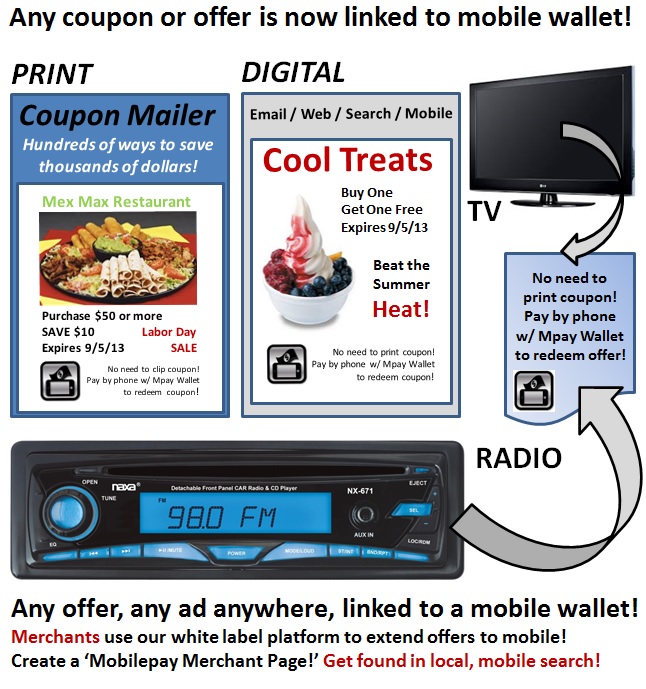

I believe this is the future of retail coupon and offer advertising. The mobile/digital wallet shall be the container for all offers/coupons. Linking offers to mobile wallets or payment cards provides convenience that enables consumers a life of leisure in retaining and redeeming offers. I'm kind of surprised this model has yet to come to market.

To clarify, if one sees or hears a TV, Radio, web, email or print ad and it has a "tag line and/or logo linking an offer to Mobile/Digital Wallet or Card" in the ad, one will know the offer may automatically be found and redeemed through the wallet or card without need to print a coupon/offer from email/online, clip from print ad or use a code. Saving money just got more simple and convenient.

For consumers beholden to universal mobile/card linked offers, there is no going back. Like I've said before, there is no reverse gear in technology. You don't go from an iphone back to a feature phone or from email to snail mail. Continue

By Randy Smith,

Mobile Wallet Media

August 21, 2013

Digital gifting of $2 - $10 mobile gift cards and incentives appear to be a solid conversion and engagement bridge for consumers and mobile payments. Wrapp, Gyft and LevelUp are a few startups leading the way. Wrapp and Gyft have had huge success of pairing Social Media with sharing of mobile gift cards. Continue

By Randy Smith,

Mobile Wallet Media

August 28, 2013

You’ll soon be able to withdraw cash at ATMs using your phone. NFC and QR codes, used to power mobile payments, will also be used for mobile or cardless ATM transactions.

In July, MCX partnered with FIS Global and PULSE partnered with Paydiant.

The MCX partnership appears to be aimed at lowering processing costs for network retailers. FIS owns the NYCE network which enables PIN debit and ATM transactions nationwide. This partnership will mobilize transactions for NYCE at retailers such as Wal-Mart, Target, 7-11, Kohl’s and another 20+ top US retailers. Continue

By Randy Smith,

Mobile Wallet Media

September 9, 2013

PayPal has taken a big step in the right direction with its new mobile payment app. The previous design was straight out of 2003 (yes, I'm aware apps did not exist until 2008). However, for a mobile wallet to have a fighting chance it needs to provide more convenience and security than the physical wallet. Continue

By Randy Smith,

Mobile Wallet Media

October 3, 2013

In past two weeks we’ve seen a slew of announcements prior to the mobile payment/wallet industry’s upcoming ‘Super Bowl Event’, Money2020. No clear universal standard enabling ubiquitous mobile payments has emerged, quite to the contrary, with PayPal and Apple both announcing beacon services and quirky Clinkle making a 25-million dollar, sound NOT heard round the world, splash into mobile/digital payments. While the payments industry does not face the problems our nation now faces with reaching a consensus on the national debt, a budget and healthcare, it still has some pretty big problems to overcome to achieve scale. But alas, recent announcements by PayPal, Apple, Facebook, LevelUp, CARDFREE & Paydiant show real signs of life for advancing mobile payments.

By Randy Smith,

Mobile Wallet Media

October 18, 2013

Showcasing innovation in mobile and digital payments, loyalty and security is what Money2020 was all about. I was able to interview 20+ companies and discover a few rising stars offering game-changing innovation. I'll start with major announcements, highlight the top innovations and key conversations at the conference.

Top Announcements

PayPal may be growing past it's awkward tween years into a full blown, scalable mobile payment solution. I last reported on PayPal the day after they updated their app and the day before they announced Beacon. In this article I suggested they implement a dynamic PIN and what do you know they listened! LOL! (I did however make this same suggestion over a year ago as well). The announcement of Payment Code paired with Dynamic PIN is the solution PayPal is going with. What will happen to showing your picture to pay, only time will tell. A year ago I said it had scalability issues.

By Randy Smith,

Mobile Wallet Media

December 31, 2013

Is it all just about having the loudest megaphone? This megaphone being media coverage, a budget for advertising or for growth capital or political swaying contributions. Can big and bold innovation succeed if not introduced by a power brand or resume and big money? And are the incumbents really willing to disrupt their status quo solely in serving the best interest of their customers or citizens? The consumer and citizen lose out because of this prejudice against innovation originated from outside incumbent leaders. If you've read my articles before, you know I'm not out to win a popularity contest (except on behalf of innovation and I already won such a contest at TechCrunch Disrupt in 2010), I'm here to highlight innovation and reveal the barriers against it. Continue

By Randy Smith,

Mobile Wallet Media

May 6, 2014

Ondot Systems just announced 18 million in funding for their ‘Remote Control Card App’. The app gives cardholders the final say in payment card transaction authorizations. Cardholders will be able to turn their cards on and off, thus giving them lock and key control over their payment cards. Is this not long overdue?

In a nutshell from a TechCrunch article “With CardControl, we were able to decrease our fraud losses from $450,000 in 2012 to $180,000 in 2013, a reduction of over 60 percent. This has been a big breakthrough, and justifies the solution on its own,” says David Penoli, LSNB’s COO. “Getting our cardholders to use their cards over 50% more has been the most cost-effective way to increase debit card margins.” Continue

By Randy Smith,

Mobile Wallet Media

May 21, 2014

The Target breach was a recent catalyst in igniting the fraud solutions war pitting EMV vs. ‘Lock and Key.’ EMV you know, but Lock and Key? As covered in my prior article Ondot Systems and TSYS both recently announced they are offering a service enabling consumers to use a mobile phone app to lock and unlock or set parameters for card usage by proximity, one-time use and more. Continue

Copyright 2012. All rights reserved, Mobile Wallet Media, Inc. News & Opinion on the Future of Mobile Payments & Commerce!

Sponsor Spotlight Coming Soon! >>

One of my favorite lines is from the movie National Treasure. Actor Nicolas Cage is closing in on his family's long sought after Mason's treasure. He reconfigures his 200-year old tobacco pipe as he realizes the key clue "The secret lies with Charlotte" may actually be an actual key to grant access to the treasure room. The pipe was obtained earlier in the movie from a 200-year old ship named "The Charlotte" which was lost at sea in the Antarctica and found covered under the ice and snow. At this moment he states "Can it really be this simple?" Well, truth be told and be bold it could be that simple to provide a much improved identity theft solution.

By Randy Smith,

Mobile Wallet Media

August 27, 2014

By Randy Smith,

Mobile Wallet Media

September 8, 2014

According to early media leaks it seems to be an all foregone conclusion that Apple will announce on September 9 that it's entering mobile payments. Amid these reports NFC will be in the iPhone 6. This could turn the beaten down reputation of the 'Not For Commerce' chip into the centerpiece of an iCommerce platform. If Apple enters the game armed with NFC, PayPal and MCX may need to adjust their game plans. Continue

By Randy Smith,

Mobile Wallet Media

September 30, 2014

Money2020, the must attend payments event, is just a month away. It’s time to get up to speed on the hot topics of Apple Pay, tokens, and wallets. Read story

By Randy Smith,

Mobile Wallet Media

November 20, 2014

Mobile and Digital Payments News