By Randy Smith,

Mobile Wallet Media

October 18, 2013

About Mobile Wallet Media

Mobile Wallet Media is a news media, analyst, marketing and consulting firm focused on the future of mobile: payments, marketing, loyalty commerce, security, prepaid, virtual currency, daily deals and the convergence of them all with social and local. The Chief Editor, Randy Smith, was the primary founder, inventor and former CEO of MobilePayUSA, a TechCrunch Disrupt Startup Alley Winner.

Media Partners

Page 2 of 2

Top Innovators Con't

2012 - SuperCommerce Series

Search, Social or SuperCommerce?

The key to commerce shall be the seamless completion of the value and convenience chain for consumers and merchants alike.

How may Google, Facebook and First Data disrupt Daily Deals? Will EVOLUTION lead

to REVOLUTION? How about M&A?

Daily Deals Manifest Destiny

Can one live on deals alone?

Tour D' Mobile Payments

PayPal, Google Wallet, ISIS, Square & more. What are the barriers to adoption and how they may be overcome?

AUG

SEPT

SEPT

The Future of Money

Where will payments be in 2020? Will mobile over take cards & cash? Learn how a 'Secure, Social & Rewarding' wallet will disrupt it all?

Bridging the POS GAP

NFC is Tortoise and the 2D Bar Code is the

hare. Retailers, simplify the myriad of choices!

Learn how DISRUPTION is RIPE for 2013!

OCT

OCT

Greed is NOT GOOD!

Cause Commerce IS!

Cause Commerce can set you apart! Learn what it is, why it will soon be, non-optional, and how it will add to your Social Brand.

NOV

Loyalty LIKE Never Before!

The convergence of Social & Rewards is here!

Learn how Top of Mind & Automation will rule! Maximize, Mobilize & Unify Ads & ROI!

NOV

Companies and leaders, to remain relevant and profitable, must embrace innovation or risk becoming irrelevant or extinct.

Top 5 Killers of Innovation!

HDTV - High Def. Total Vision Where are your Blind Spots?

Connect the dots! See the big picture!

If your Mobile Strategy is unclear, you may be

missing key pieces. Get a holistic perspective.

AUG

DEC

TM

New Series for 2013

The 'Disruptive Innovation Meteor' named MOBILE has struck the world's of retail payments, banking and marketing. Firms wanting to survive, compete and win in this new environment must adapt by embracing disruptive innovation or risk becoming irrelevant or extinct. Read story

IF YOU FORGOT WHAT INNOVATION LOOKS LIKE

WATCH IPHONE'S FIRST COMMERCIAL BELOW . . .

Disruptive Innovation and Dysfunctional Dinosaurs

image source: abcnews.go.com

Copyright 2012. All rights reserved, Mobile Wallet Media, Inc. News & Opinion on the Future of Mobile Payments & Commerce!

Sponsor Spotlight Coming Soon! >>

Enter code MWMDISC for 10% off (thru July 26)

Paydiant

Paydiant is growing leaps and bounds through partnerships with processors and retail and banking wallet and technology providers. The company was established in 2011 and recently added 15 million in venture capital to fuel it's growth. The companies listed above, FIS Global, CU Wallet, Vantiv and Subway are just a few of the recent partnerships established with Paydiant to power and expand their white-label mobile wallet solution.

FIS Global

FIS Global is a giant in the banking and payments space with a 45 year history and banking relationships with 9 of the top 10 banks and employs more than 35,000. FIS's partnership with Paydiant added more than just reach to financial institutions for Paydiant, FIS married Paydiant's mobile wallet to replace the need to carry your debit card to withdraw cash at an ATM. The ATM transaction is moved to the mobile banking app jointly powered by Paydiant and FIS. The user walks up to the ATM and presses a "Mobile Cash Access" button on the ATM screen. The user then opens their mobile banking app, logs in, selects to withdraw cash, selects the account to withdraw from and the amount. Within seconds, the cash is dispensed and a paper receipt is printed. Key benefits to this tech is consumers may withdraw cash from ATM's in seconds, thus adding physical security and prevent card skimming at the ATM.This is very cool, but perhaps what's cooler and adds perception of greater security is the marriage of mobile wallet app with the mobile banking app. Banks may yet win in the end! Watch this 30-Second video below of a live transaction using this tech.

CU Wallet

I had the opportunity to sit down with Paul Fiore, Co-Founder of CUWallet, whom led credit unions into online banking as founder of Digital Insight. Paul shared about their CUSO which includes 500 credit unions and millions of members. Seems to me the reach and relationships paired with the Paydiant platfrom integrated with CU Wallet's mobile banking platform will lead to mass adoption by members.

Subway

Plans are for Subway to roll out Paydiant's white-labeled app later this year. Subway chose Paydiant because of it's speed and low cost to adopt, add loyalty features and because it does not require expensive new software or hardware, but only a indtegration to Paydiant's platform. Stay tuned for more major retailer announcements of partnering with Paydiant.

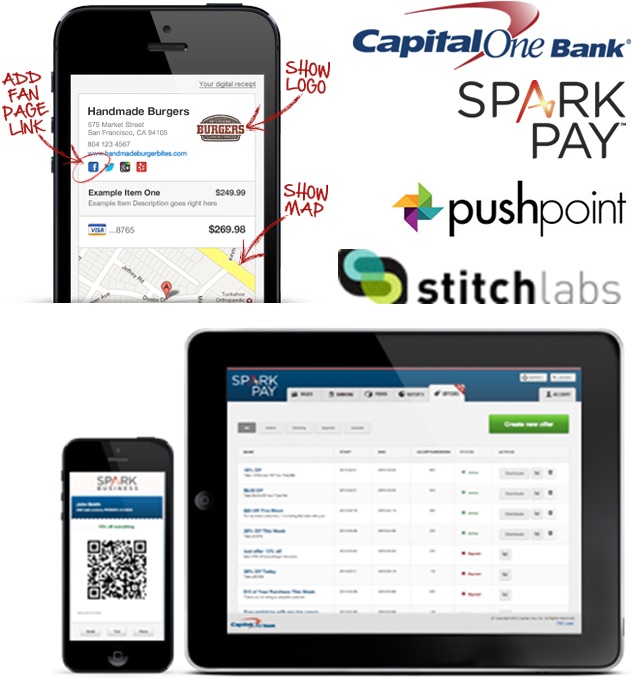

Capital One SparkPay

Partners w/ PushPoint & StitchLabs to Prosper Small Biz!

This trio of companies has worked together to create a seamless and powerful tool for small business to create and push relevant offers to local mobile and targeted consumers and manage and merge inventory and e-commerce (Stitch Labs). Creating and pushing offers to mobile customers near your store may never have been so easy. Merchants may use simple tools to send offers through PushPoint's local area mobile marketing engine (using geo-fencing) in the form of ads delivered to mobile phones and target content in alignment with a merchant's customers. Plus everything is seamlessly integrated for simple and fast redemption of offers at point of sale with a SparkPay tablet and consumer app. Of course Capital One has an outstanding customer base and reputation for offering consumer and small business friendly services. This service only stands to build upon this reputation.

VerifyValid

I had the opportunity to sit down with Paul Doyle, Founder and CEO of VerifyValid. This company has produced a very unique and cool product. Checks may be created, expensed, authorized, distributed, received and even deposited in seconds to minutes, all electronically to email, SMS or mobile app. Recipients may print paper checks for deposit or RDC. They estimate companies sending or issuing checks save $1 per check by using their system and software. Paul pointed out that 24.5 billion checks were processed last year for 31 trillion in dollar volume. This is nine times the dollar volume of all card payments! Deluxe is a VAR and their software is integrated with Quickbooks desktop with online registration coming soon. Upon upload of CSV files, VerifyValid creates a batch file. They expect to have an iOS7 app ready by year's end. Watch their 2-minute video below to learn more.

Valid Soft

Validsoft uses biometric and multi-factor authentication to reduce fraudulent transactions. Users can create their voice imprint file by simply speaking into their phone. The service is used in combination with additional out of band authentication to reduce fraud and false postives. A very strong use case for example is online funds transfer.

Mitek Systems

Mitek Systems projects by 2016 mobile banking will grow by 300%! Yes, Mitek is already a king of the castle regarding image capture of checks as they serve 1,000 banks and 10 of top 10 banks. Their products are distributed by FIS, Fiserv and NCR. So even though they

are leaders they continue to innovate by turning your camera into your keyboard. Consumers can for example move cross country and open a new bank account by simply snapping a pic of their drivers license and a check from their former bank. Banks embed Mitek's tech into their native app. Progressive Insurance uses tech to snap a picture of drivers license to get instant quote.

Got a bill that's due isame day or next?

Fuze Network is the nation’s first method to quickly and conveniently send money to any card. The company’s reCHARGE™ service ‘fuzes’ together existing networks to enable bill payments, cash deposits and prepaid reloads with the same effort to make regular purchases. Users simply swipe their card and pay. Fuze Network is the easiest, most cost-effective method of increasing retail traffic and building payment transaction volume.

Check = Mint + PayPal

Check recently received an additional 24 million in venture capital and for good reason as they have enrolled over 10 million customers. Check brings

together the world of personal finance with payments. They are focused on the $4 trillion bill payments market (the market value). Interestingly 2/3 of bills (more than 10 billion individual bills) are paid at the billers site. They also target the 1/4 of bills paid (4 billion billion bills/year) by check or money order. These numbers surprised me. You? I thought the convenience of online bill pay was dominant now, but if one can pay all their bills using a credit card from one site and earn rewards, it makes more sense. Billers provide paperless billing thru Check saving them money and consumers time in paying at each site. 1/4 of consumers paying bills by mail save time and money on postage. Their focus is on partnering with billers to enable customers to pay bills. Only an email address or phone number of the biller is required to pay a bill. Check should be a fast and high flyer!

Save Thousands, Win Millions.

Get rewarded to save money or pay down debt.

They are integrated with Quickbooks and Turbo Tax and offer bank level security. They also just announced a pilot partnership with PayPal. Learning and earning was never so cool!

Mercury Payment Systems has been a leading innovator for some time now. They recently partnered with PayPal to extend their reach to consumers on behalf of their merchants and POS partners and is also working with a few other mobile wallets as well. Mercury is an acquirer/processor with 580 POS systems and 2,500 VARs or dealers.

Randy Clark, SVP Marketing for Mercury shared "The main barrier for merchants is ROI. If we can speed the line along that's more money in the pocket for merchants. Right now we are in the pilot phase and working out the kinks to scale. We want to make sure the whole value chain is working out. We need to be both channel and product ready. We are cementing how dealers will make money and how in the value chain do we work together and support the solution. Our pilot says in 5 years we are going to see some big numbers. We are bullish on PayPal's broad payment strategy."

Cardlytics is a pioneer in the card-linked offers space. They distribute offers through online and mobile banking services. Offers are redeemed with bankcard purchases. Consumers login and tap or click on offers to activate them. Offers are generated on past transaction history. They work with hundreds of FI's including BofA in powering BankAmeriDeals. Merchants get purchase data and the service is free to banks. Cardlytics earns revenues from retailers. Our technology is installed with banks. They are building out a location based offer engine. I see them continuing to lead innovation in the space.

Conjunction junction what's your function? Hooking up Enterprise API's and making technology work is what Layer7 Technologies does very well. Their services around API's are extensive. They assist developers in constructing and executing their API strategy for companies such as Visa (v.me), MasterCard and AMEX. They focus on working in retail, government and financial services. Fundamentally they sell software and enable legacy systems into mobile orientated API's. Layer 7 was acquired by CA technologies which has it's roots in the mainframe business, thus capitalizing their business thru Layer 7.

Money2020: Top Mobile & Digital Payments Announcements & Innovators

Vantiv

Vantiv, formerly known as Fifth Third, has rebranded itself to break the old mold, into a hip new brand. By partnering with Paydiant it is hitching itself to an innovative and bold future. It showcased some pretty cool vending tech using Paydiant's platform.

Clover debuting at Money2020 was recently acquired by First Data. When I see this product, I think Apple. The product aims to leverage First Data's extensive network. Clover replaces your cash register, payment terminal, receipt printer, and barcode scanner with an all-in-one solution. First Data is continuing to open up it's network.