About Mobile Wallet Media

Discussing the Future

of Mobile Commerce!

Our SuperCommerce Series

Search, Social or SuperCommerce?

The key to commerce shall be the seamless completion of the value and convenience chain for consumers and merchants alike.

How may Google, Facebook and First Data disrupt Daily Deals? Will EVOLUTION lead

to REVOLUTION? How about M&A?

Daily Deals Manifest Destiny

Can one live on deals alone?

Tour D' Mobile Payments

PayPal, Google Wallet, ISIS, Square & more. What are the barriers to adoption and how they may be overcome?

AUG

SEPT

SEPT

The Future of Money

Where will payments be in 2020? Will mobile over take cards & cash? Learn how a 'Secure, Social & Rewarding' wallet will disrupt it all?

Bridging the POS GAP

NFC is Tortoise and the 2D Bar Code is the

hare. Retailers, simplify the myriad of choices!

Learn how DISRUPTION is RIPE for 2013!

OCT

OCT

Greed is NOT GOOD!

Cause Commerce IS!

Cause Commerce can set you apart! Learn what it is, why it will soon be, non-optional, and how it will add to your Social Brand.

NOV

Loyalty LIKE Never Before!

The convergence of Social & Rewards is here!

Learn how Top of Mind & Automation will rule! Maximize, Mobilize & Unify Ads & ROI!

NOV

Companies and leaders, to remain relevant and profitable, must embrace innovation or risk becoming irrelevant or extinct.

Top 5 Killers of Innovation!

HDTV - High Def. Total Vision Where are your Blind Spots?

Connect the dots! See the big picture!

If your Mobile Strategy is unclear, you may be

missing key pieces. Get a holistic perspective.

AUG

DEC

TM

2013 Series

The 'Disruptive Innovation Meteor' named MOBILE has struck the world's of retail payments, banking and marketing. Firms wanting to survive, compete and win in this new environment must adapt by embracing disruptive innovation or risk becoming irrelevant or extinct. Read story

IF YOU FORGOT WHAT INNOVATION LOOKS LIKE

WATCH IPHONE'S FIRST COMMERCIAL BELOW . . .

Disruptive Innovation and Dysfunctional Dinosaurs

image source: abcnews.go.com

Copyright 2012. All rights reserved, Mobile Wallet Media, Inc. News & Opinion on the Future of Mobile Payments & Commerce!

Mobile Wallet Media is a news media, analyst, marketing and consulting firm focused on the future of mobile: payments, commerce, daily deals, security, loyalty, marketing, prepaid cards, virtual currency and the convergence

of them all with social and local. Learn more

Sign up today for our

free email newsletter!

Easily track the most relevant payment news

and articles by MWM.

In browsing the booths I came across a very interesting technology by Oberthur Technologies.

They have developed an integrated, dynamic CVC code. The technology is built into the card.

The CVC is displayed in the same place as usually found printed. This card tech integrates the display (LCD?) and chip to enable a dynamic CVC for each card. It works akin to RSA technology for computer login.

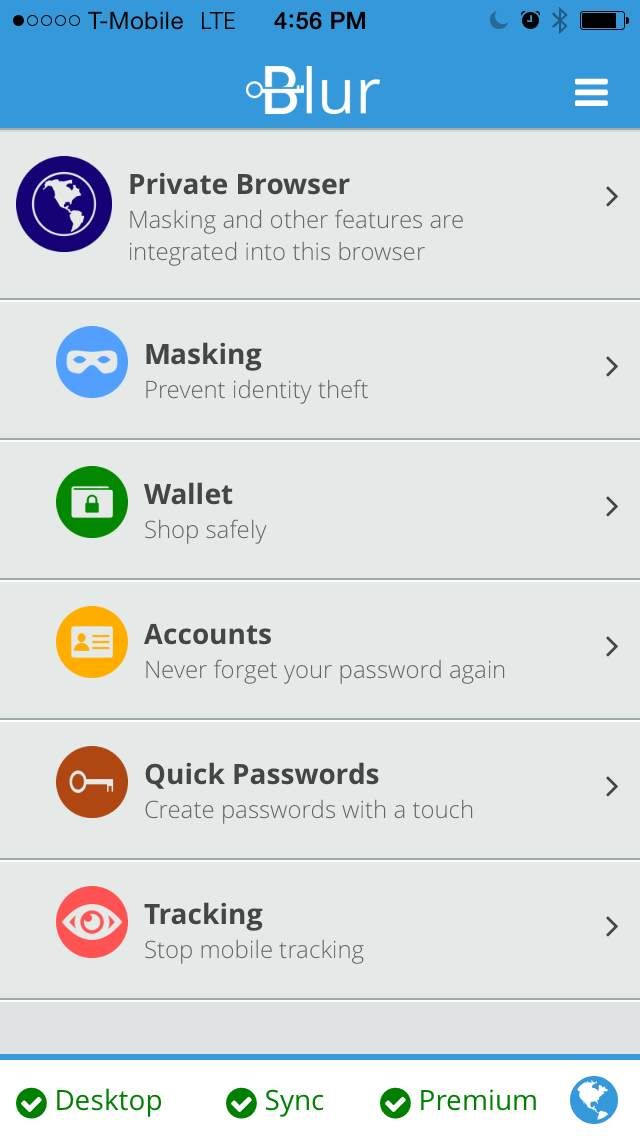

I had the opportunity to sit down with Abine's CEO Rob Shavell to learn about their innovation named Blur. Blur is the all-in-one solution for managing your online life and protecting private info.

The CVC is randomly generated. A matching algorithm is securely stored in the cloud for authenticating transactions. If a cyber thief gets hold of your stolen card info it will be useless as the CVC changes on a regular basis. This new technology is now or soon will be in pilot and commercial shipments are slated to begin in first half of 2015.

Page 2 of 2 > Money2020 Top Financial and Payments Innovations

With millions already using Blur and 500K monthly downloads Blur is no newcomer. So what is Blur?

It's first a private browser for mobile and desktop. It allows you to control who gets your private info. It uses masking technology to create alias passwords, emails or credit cards.

When using it's private browser Blur only kicks in when on a form page, be it enrollment or payment to populate fields in seconds.

Cards may be securely added and stored by Abine in a wallet. Upon checkout users may choose their card to charge and generate and populate a one-time use virtual MasterCard number to make the purchase. This card number is simply used as a routing tool to engage the Blur mobile wallet and charge the card chosen by the user.

Blur also incorporates DoNotTrackMe tech to prevent mobile tracking. This app has got to be one of the most useful apps I've encountered.

I'm covering Marqeta for a third straight year at Money2020 because they continue to innovate.

Marqeta recently introduced it's open API for issuers of closed loop programs. Their innovative and flexible platform is built upon an open-loop Discover or MasterCard card.

Third party developers or issuers may create and deploy unique stored value, loyalty and offer hybrid programs. Cardholders may redeem offers or stored value via the swipe of a card, online or mobile.

When the card is presented for authorization the merchant ID is captured along with the card credentials. Marqeta's platform houses the stored value and offers for real-time redemption and authorizations. All transactions ride the rails of MasterCard or Discover to reach Marqeta's closed loop platform.

A great example of a third party use of their platform is Oink. The Oink Card is a prepaid card that adults may load and give to kids. The card enables spending of tracking and parental control of where their child may spend or shop and how much.

Modo is a very cool tool for third party developers or merchants to issue virtual stored value and offers, loyalty and more. There’s NO POS integration required. It’s all done through a mobile app and existing POS systems. From instant purchase enablement to instant offer or virtual gift card issuance, Modo enables it. Modo has partnered with CashStar to make it all possible.

POPcodes are a pretty darn simple and powerful tool. POPcodes seamlessly connect online purchases to in-store pick up of merchandise. Retailers use to increase online conversion rates, customer satisfaction and drive customers to their stores. POPcodes are directly integrated to work at your existing POS terminals.

POPcodes work by issuing consumers a POPcode for instore pick up. In store consumers enter their phone number or POPcode and pin to pick up their online purchase.

MX, formerly MoneyDeskTop, is at the leading edge of innovation in mobile banking. It understands the wants and needs of the 'Mobilized Millennial'.

I had the opportunity to sit down with Ryan Caldwell, CEO of MX. His passion to deliver the best possible digital banking application via the Helios framework is quite evident. This has lead MX to be the platform of choice by 500+ FI's and 200% year over year growth. To continue to pile on accolades they have won five consecutive Best of Show awards at Finovate conferences.

The MX platform is focused on the end user. It provides tools to aggregate all a customer's accounts into a single cool and contemporary interface. Ryan said "To be an advocate for the end user you have to aggregate." Their new Helios framework aggregates from 20,000+ feeds to empower framework to deliver customers the data they want.

In watching the demo new Helios framework I was asked if I ever saw an mobile banking app deliver game-like graphic performance and design. Of course I said no and that I'd only seen such a quick responsive mobile app in the movies about the future. Ryan went on to tell me about how they have built their platform upon C++. In summary a bit of paraphrase of what Ryan shared "This not only makes it device agnostic but it is what makes it powerful and fast. It's better than building to a native mobile platform. It's costly and difficult to program in C++, but the performance, appearance and features of their framework make it worth it."

This framework opens up banks to add new users via retail promotions to sign up and receive free movie tickets, etc.. It also allows user the freedom to view all their financial accounts and transactions in single place.

Kash is an independent mobile payment network that charges merchants up to 80% less than traditional credit card payments.

CEO of Kash, Kaz Nejatian is on a mission to build a better network.

The innovation here is the secure layer of a dynamic QR payment code to connect to a bank account to decrease transaction costs. All this while working without celluar service.

How this technology actually works and is really a creative use of pairing existng tech.

From the Kash site I'll let them desribe their app and service best: "Credit card theft requires just a number and expiry date. Kash payment codes are created when needed, expire in 60 seconds and only work on approved retail terminals ... One tap to pay and digital receipts delivered to your phone. Designed to work in the real world where data connections aren't always reliable ... Like collecting stars and stamps? It's built right into Kash so you never have to fumble between paper cards or different apps again."

Viewpost is a secure business network for invoicing and payments.

Viewpost provides a dashboard to see all your accounts receivable invoices. A key innovation here rests in the ability to manage cash flow via enabling issuance of discounts off amount due if paid immediately or within a set time frame. Viewpost cleverly calls this Dynamic Discounting. So if your company is short on cash to meet daily, weekly or monthly obligations you may issue offers to clients to receive a discount by paying bill early. Users may also know the status of an invoice. And users may get paid electronically to their bank accounts without sharing account info.

It's free to send and track invoices, but the cost to send and receive payments is a bit high. Perhaps they have tiered pricing? Also, Viewpost did choose to not white-label their service, which I believe will spur competitors to do exactly this or build their own.

Acorns enables users to invest spare change automatically from everyday purchases into a diversified portfolio. It's like a digital change jar. This idea pure genius and enables anyone to squirel away cash automatically and simply. It's a perfect way to start saving every time you pay. It works by rounding up the amount paid, the spare change is deposited into you investment account.

And last but certainly not least is Spare, a cause commerce model and the Money2020 Hackathon Champ. Consumers using Spare can round up to donate up to 99 cents to feed hungry New Yorkers.

Spare is socially adept and users can earn rewards after they make 3 donations or more. Rewards include a complimentary cocktail, a dessert or a $15 off next visit. Spare is starting in NYC, but the model can work in any city for any cause. I see Spare collecting an abundance of spare change beyond NYC in their quest to feed the hungry people.

That's it!

Merry Christmas and Happy Holidays!!!

Feel free to connect on LinkedIn.