Our SuperCommerce Series

Copyright 2012. All rights reserved, Mobile Wallet Media, Inc. News & Opinion on the Future of Mobile Payments & Commerce!

Sponsor Spotlight Coming Soon! >>

About Mobile Wallet Media

Get your company

Money2020 Expo - Key Conversations and Companies & Services to Watch

Search, Social or SuperCommerce?

The key to commerce shall be the seamless completion of the value and convenience chain for consumers and merchants alike.

How may Google, Facebook and First Data disrupt Daily Deals? Will EVOLUTION lead

to REVOLUTION? How about M&A?

Daily Deals Manifest Destiny

Can one live on deals alone?

Tour D' Mobile Payments

PayPal, Google Wallet, ISIS, Square & more. What are the barriers to adoption and how they may be overcome?

AUG

SEPT

SEPT

The Future of Money

Where will payments be in 2020? Will mobile over take cards & cash? Learn how a 'Secure, Social & Rewarding' wallet will disrupt it all?

Bridging the POS GAP

NFC is Tortoise and the 2D Bar Code is the

hare. Retailers, simplify the myriad of choices!

Learn how DISRUPTION is RIPE for 2013!

OCT

OCT

Greed is NOT GOOD!

Cause Commerce IS!

Cause Commerce can set you apart! Learn what it is, why it will soon be, non-optional, and how it will add to your Social Brand.

NOV

Loyalty LIKE Never Before!

NOV

Companies and leaders, to remain relevant and profitable, must embrace innovation or risk becoming irrelevant or extinct.

Top 5 Killers of Innovation!

HDTV - High Def. Total Vision Where are your Blind Spots?

Connect the dots! See the big picture!

If your Mobile Strategy is unclear, you may be

missing key pieces. Get a holistic perspective.

AUG

DEC

TM

By Randy Smith,

Mobile Wallet Media

November 2, 2012

About Mobile Wallet Media

Mobile Wallet Media is a news media, analyst, marketing and consulting firm focused on the future of mobile: payments, marketing, loyalty commerce, security, prepaid, virtual currency, daily deals and the convergence of them all with social and local. The Chief Editor, Randy Smith, was the primary founder, inventor and former CEO of MobilePayUSA, a TechCrunch Disrupt Startup Alley Winner.

The convergence of Social & Rewards is here!

Learn how Top of Mind & Automation will rule! Maximize, Mobilize & Unify Ads & ROI!

Mobile Wallet Media is a news media, analyst, marketing and consulting firm focused on the future of mobile: payments, commerce, daily deals, security, loyalty, marketing, prepaid cards, virtual currency and the convergence

of them all with social and local. Learn more

The focus of the event was clear. Mobile and Digital Wallets are the future. Many great

insights were shared by top executives, providing a preview of their direction & focus.

Is Bluebird the way to fly in prepaid? This fee free model should do well.

You would never have guessed this was the premier event for Money2020 Expo. The abundance, quality and diversity of keynote speakers, presenters, panels, moderators, exhibitors and attendees would, if you were an industry outsider, make you think the event had been held for years. It was impossible to capture it all and attend all panels and meetings! I'll start with companies I interviewed.

American Express

Joanna Lambert of American Express shared with me a bit of the company's vision and focus of the future:

"We want our Serve app to be used several times a day. This requires an intuitive interface focused on saving time and money. Maybe it's saving a trip to the bank or receiving a notification from your local bakery when the when rolls are hot and fresh? . . . We want to help merchants to drive incremental value and increase consumer loyalty . . . We are very open to partnering to reach our goal of being agnostic . . . With Bluebird our aim is to make loading money and transacting as fast and simple as possible . . . We are spending a lot of time asking what consumers want. We are transitioning from a payments company to service company."

I've always seen Amex as delivering extra value via services like OPEN and their concierge services. If they can continue to provide that extra value and merge it with Serve, I believe this is a winning formula. By the way, we all can take part of Amex's upcoming nationwide event, Small Business Saturday. This event on November 24th has the right focus, social strategy and charm to make for a big hit in supporting your local small business. Check it out and spread the word!

First Data

I sat down with Dominic Morea, Mark Herrington and Elizabeth L. Grice of First Data to hear first hand about their new merchant and consumer engagement platform Universal Commerce.

Here's what they shared: "Universal Commerce is a framing strategy. We've realigned product around this concept. We reach over half of the terminals in the U.S. and pairted them with our Open API - Rapid Connect. New value-added services and offers tied to transactions can be delivered seamlessly. We have the ability to recognize a consumer and link relevant offers. We can help publishers with precise results."

I've looked far and wide and First Data does have a solid vision about a the future of connected or Universal Commerce. It's worth taking a look at their 3-minute video below about Universal Commerce.

First Data's Vision of Universal Commerce

Bill Highway

I had the pleasure of speaking with Michelle Lange, the CMO of Bill Highway. I love their niche focus on non-profits to deliver credit card acceptance via a smartphone dongle device. Bill highway is certainly no startup, but a 13-year old, Michigan based company. They also just presented at Finovate Fall 2012.

I believe the opportunity for non-profits via Bill Highway is huge. It makes so much sense! How simple is it now for non-profits to capture donations via their new Give app. The app demo was fast & simple!

Michelle shared: "Our key differentiator is focusing in non-profits and solving their problems. Our core focus is to help with revenue through mobile fundraising. We also do it through online banking via 5th 3rd bank. We bring the entire billing ecosystem together and is automated and transparent. We handle billing for 80% of all national sororities. We assisted Tri Delta to reverse a 1 million dollar loss one year into a 1 million dollar gain the next year."

FreeMonee

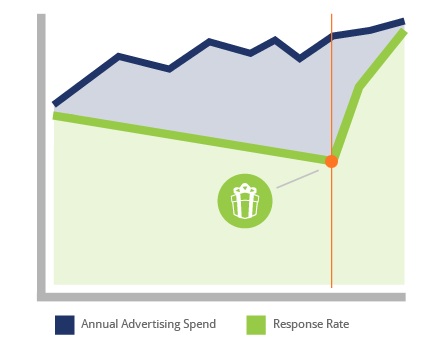

FreeMonee generates marketing lift! This seems to be a new way to fly! FreeMonee has partnered with US Bank, Discover and Capital One to deliver FREEMONEE GIFTS! And this is not just a one-time thing. FreeMonee gifts are delivered with no strings attached on a weekly basis. This is a model I've seen before with Direct Mail gift cards on a monthly or seasonally basis, but this is the first I've seen like this. A key difference is the seamless redemption process with a discount being deducted immediately at time of the sale or as cash back to your card.

FreeMonee's tag line is "Delivering Customers On-Demand > Retailers: Get the customers you want, when you want them and where you want them with FreeMonee Gifts." This company has much promise vs digital coupons and offers. This is one I'll keep my eye to see if it takes off.

I sat down with Jim Tashetta the CMO of FreeMonee to learn more. Jim shared "The company was founded on simple principle that gift cards are a better incentive than coupons. Gift cards are 10-times more effective than coupons. So why aren't retailers just giving out cards in mass? Direct mail is expensive. We partnered with large banks to achieve scale for campaigns. Once a week consumers get gift message. An offer to earn cash back to their card."

Jim continued on "We launched in 2011 and are running test campaigns with Williams-Sonoma. Our gift underwriting engine builds algorithms to predict how much you are going spend. The lift averages 5x over shoppers without gifts. We provide ROI analysis and proof of generating sales. Banks can monetize data in a way that is merchant and consumer friendly. Consumers are willing to let you use their data so long as they receive value."

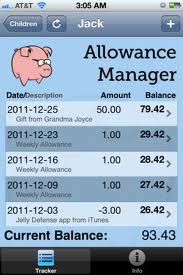

Allowance Manager

This app works to teach kids how to budget, save and appreciate the allowance they have earned. It also serves as a way to track allowance spending. Parents and kids alike can know how much allowance is left for kids to use and how much they have saved.

Allowance Manager CEO, Dan Meader shared "I was at CostCo with kids and they wanted to buy another video. We could not agree on how much allowance was left and I decided to create an app."

Dan, who was formerly with Apple for 10 years, is clearly passionate about his app and vision. Dan went on to state "The app serves to remove emotion from the equation. The system automatically gives allowance on schedule. The app does not yet give allowance (you cannot make payments or distribute funds through this app right now). We launched in App Store 6 months ago and 18 months ago with a web app. We have over 100,000 users."

ROI

Science Behind Our Gift Underwriting Engine

I asked what are some of the cool features? Dan answered "Kids can create wish list. They can identify gifts they want. We know what kids want to buy! This app is about teaching kids to manage their money."

I asked Dan about market metrics. Dan stated "About 110 billion is spent per year by parents on purchases influenced by kids. The average kid in the US earns a $15/week allowance. There are 75 million kids in the USA."

I see this app able to garner a unique set of data from kids. The app may know kids likes and dislikes and can provide data on which purchases were made or what kids want to buy. It seems to me this will be a great tool for CPGs to learn what kids want to buy and what they are buying.

This is a company to keep an eye on as it seems ripe to take off. Dan told me the company will soon be launching significant new features in their app in coming weeks.

CrowdMob

Crowd Mob is a mobile advertising network. Their app, crāve, is a performance-based mobile advertising network. They contextually target users when they're seeking entertainment, and are highly motivated to find new apps. Whether they're waiting to board a flight, sitting in a movie theater, or bored at the doctor's office, they funnel these highly engaged, captivated users to your app.

Matthew Moore Co-Founder and CTO of CrowdMob shared his description of CrowdMob's business model with me. This is a different and unique model that solves the problem of boredom while waiting, with the fun of playing games, plus earning real reward vouchers.

Matthew said "We are currently in pilot with 7-11 and use exploding, digital vouchers to issue and redeem rewards. That is, you show the cashier the digital voucher before it disappears." Matthew also stated "We don't want to be a POS payments provider or enabler but want to stick to our core focus of mobile advertising. We are looking to partner with mobile payment companies."

Matthew went onto share "Our real niche is mobile ad spend and rev share back in form of credits. We are a virtual currency. The advertiser that makes the game pays us on pay per performance. We find local distribution at airports, bus stops, etc. through WIFI provider Jiwire. We funnel traffic to stores. Every time someone uses a game, in a similar way to AdSense click-thru, we get paid between $2 - $5. We pay 2/3 to consumer in form voucher or game credits. We turn mobile ad spend into foot traffic and LTV."

Innovative Companies on Watch List

Panels and Keynote Conversations

Monday - 8:30AM Panel

Mobile Enablers for Commerce & Payments

Moderator - Ed Naff, VP CSMG

Paul Tuscano - Associate Director, Verizon Wireless

Sidhar Raghavan - Nokia Siemens Networks

Bill Davidson - VP, Mobile Commerce, Qualcomm

Simon Wakely, VP of Enterprise & OEM in Mobile Security, G&D

Mehul Desai - Co-founder & Vice Chariman, C-Sam

Mod - 630m NFC devices to be shipped in 2016. - What is tech that will enable payments between now and then?

Sridhar - The tech which we have created runs on every handset.

Mod - Speak alternatives to secure device. How we help make transactions secure?

Simon - 4 types of security to authenticate user: sim card, secure element, trusted execution environment with io, the cloud.

Mod - Using cloud services?

Bill - We are using cloud, scanning barcode. We are seeing great results in Burger King.

Mod - As carrier what cam Verizon do with carrier billing?

Paul - We are focused on digital goods but eventually we want move to tickets. The roadblock to ticketing us mostly regulatory.

Mod - What have you seen that can leverage tech to add value?

Ed - We have very inefficient ad model now. It's not about presenting coupons. It's about alert.

Moving money from inefficient spend to adding value into product. Using phone to replace keys is an example of tech that provides value and convenience. Transaction driven couponing has been at best 1-200. Navigating coupons is a difficult proposition.

Bill - Augmented reality. Point phone at clothes to bring up data on products and what is available and in stock. Payment is necessary to close the loop.

Sridhar - People take cash out of ATM and get nothing for it.

Paul - Isis launched today in Austin and Salt Lake City.

Audience ? - So many phones are enabled with NFC but people do not use them?

Paul - Use cases are there. Keys and data transfer via bumping phones.

Ed - I would pay to have Bluetooth work better in my car. How do we use device to drive commerce. Me loading coupons onto my card at Safeway and tie it to register. Cloud based services like PayPal has problem at POS of getting Digital ID entered.

Ed - 300 billion promotion spend and 700 billion in ad spend it's a trillion dollar spend.

Monday 9:15AM Presentation

Mobile Case Studies

Presenter - Vinny Lingham - CEO of Gyft

This was a very visual presentation with demo of Gyft's app. It began with the use of "Scratch Tech" on the touchscreen to reveal card number. This was very cool! He created and sent off an egift in like 10-15 seconds!

Vinny went on to say "The problem with Passbook is it gets to cluttered . . . When someone walks into store with a $5-$10 gift card they end up spending $30-$40."

Audience ? - What percentage of merchants have trouble scanning codes?

Vinny - I don't know for sure, but 99% of merchants can manually enter card number.

Audience ? Used for Refunds?

Vinny - Yes.

Monday 1:50PM Keynote Presentation

Money Mangaement

Moderator - Marilyn Bochicchio, CEO, PayBefore

Keynote Speaker - Osama Bedier, VP, Google Wallet & Payments

Opening Presentation:

Preamble - "48% of consumers want targeted offers when in the store. 53% want to carry all loyalty cards in their wallet. 17% of consumers or have paid by phone. Over 1,000 apps for saving money but only 4% have used apps. By 2013 mobile web will overtake desktops. 50% of google map use is mobile. The Melt - using bar codes to order. Check out Task Rabbit and Gas Buddy."

Role of Digital Wallet - "The wallet helps create rich user experiences. It must be seamless. When it comes to payments, ubquity will beat novelty every time . . . In 1958 - The Fresno Experiment was first market to be saturated with credit cards. Ubquity includes bridging. Credit cards are still embossed . . . We need to make wallet available to any connected device. 93% of commerce is still real world commerce . . . On the bankside it's about branding, pass thru data, reducing fraud, communicate with consumers. On the merchant side it's about driving measurable traffic, engaging customers anywhere, and respecting data . . . The Mobile ecosystem is 2 devices (smartphone and tablet) . . . The more clicks the less the conversion. We are excited to announce we'll be launching new Google Wallet next month. We leveraged TXvia to launch our core platform."

Moderator sits down with Osama:

Mod - Should banks be afraid of you?

Osama - Those that jump in benefit and fear causes delay.

Mod - NFC has got a real drubbing. Why stick with NFC?

Osama - NFC is not our strategy. But in other cases it may not be required. It is only part of our strategy. NFC has become the standard and terminals are coming with NFC."

Mod - NFC as destination - it is one way to connect devices. What will you do to bridge tech?

Osama - Our goal is ubqity.

Mod - Wallet in cloud?

Osama - Getting great traction.

Mod - Thinking of bringing back prepaid cards?

Osama - We thought prepaid would bridge the gap.

Mod - Competitors - The market is hugely fragmentated. How are we going to gain ubiquity and scale?

Osama - Mobile app will work as buffer as one rich experience. The more you focus on mobile payments the more problems this will bring.

Mod - The shakeout will take years to happen. When we get to final point will there be multiple winners?

Osama - There will be multiple layers of value.

Mod - How many major players?

Osama - Mobile players will have to a platform.

Mod - Where is Apple going and when will they make their move?

Osama - Passbook is an interesting idea. But who is going to choose which apps are added to the wallet?

Mod - How do you know what consumer pain points are?

Osama - Consumers want to know they are cared about.Bbut merchants don't know whom their 20% producing 80% of sales.

Mod - Closing question - Are baby boomers on radar screen? Are you going to wait until Boomers die off?

The whole crowd busted loud laughing and Osama laughed along.

Tuesday - 9:05AM

Digital Wallets - The Battle for Consumer Mindshare

Moderator - Karen Webster, CEO, Market Platform Dynamics

Panel

Don Kingsborough - VP, Retail & Prepaid Products, PayPal

Joanna Lambert - SVP of Strategy and Business Innovation for Enterprise Growth, American Express

Ed McLaughlin - Chief Emerging Payments Officer, MasterCard

Jennifer Schultz - Head of Global Product Strategy, Visa

Osama Bedier. - VP, Wallet & Payments, Google

Mod - Tell Great Aunt Mary what a digital wallet is and why I should care?

Don - Carries all cards, coupons and saves time and money and has to be simple to use.

Joanna - Just like I send you pictures digitally, everything you will carry in your wallet you will carry digitally.

Jen - The digital wallet allows to sign in vs. having to enter card and address info and will enable you to buy and send gifts without having to go shop or go to post office.

Mod - Ed and Jen what took so long to come up with a way to transact outside the physical world?

Ed - Mobile is the most impactful device.

Jen - Mobile was a tipping device. Consumer choice is important to keep frictionless.

Mod - Asked question.

Don - Consumers want life simpler. It has to be simple. This is a consumer revolution

Mod - The Serve Wallet,-how does it fit into the landscape today?

Joanna - We linked a stored value card to digital account to enable p2p payments. We are trying to make it as open as possible with Tender Type. We have reinvented ourselves several times.

Mod - Osama. There is a difficulty of getting consumers onto platform. How do you convince consumers that their data is not to be shared?

Osama - Payments is an after thought. We want to help consumers to find what they want and reduce the friction.

Mod - How do we convince the consumer to change behavior from swiping a card?

Jen - At physical world swipe works better. We have to convince consumers that it is a better purchase experience. The tools that exist online are pretty good, you can pretty much make a decision online.

Joanna - Merchants want to drive incremental spend.

Mod - Don. NFC, do you believe that it is an enabler mobile payments?

Don - When we see it has been adopted in mass then we may consider.

Jen - The reality is that NFC has a long lead time. Merchants want flexibility. They are testing QR codes.

Mod ?

Jen - Cards work well. We see NFC as a form factor that will be adopted by consumers for how it works for them.

Mod - How many wallets?

Don - It's what you can do with the wallet. The wallet that wins is the one that works the way they (consumers and merchants?) want it to. Trust is an important factor.

Osama - The consumer will choose one wallet, but have multiple choices. This is a huge trend. Consumers are adopting ecosystems. We are focusing upon broadening our ecosystem.

Ed - We want to make sure the consumer has a great experience.

Mod - What are plans for unbanked community?

Joanna - We are trying to take a lot of fees out to serve underbanked.

Jen - Merchants have confusion between digital wallet and mobile wallet, but are focused on how will this drive more traffic. The mobile wallet solution must be very simple to train cashiers and ISOs to use.

Mod - Ferry God mother - What are your three wishes?

Osama - More collaboration.

Jen - Clear message to tell the consumers.

Ed - Tell me what is next.

Joanna - Where the tipping point is. What's the killer app that is going to drive usage?

Don - Not going to be succesful unless all major merchants have signed on. What is the end game? Having the future first is important to us.

Tuesday 11AM

Closing the Redemption Loop

Moderator - Mark Bonchekm Chief Catalyst, Orbit+Co

Panel

Ron Grant - Managing Partner, Saddle River Group and Advisor, Living Social

Varun Krishana - Head of Product, Groupon Payments

Chip Kahn - CEO, IPCommerce

Michael Murray - Chief Product Officer, Catalina Marketing

Intro Statements:

Chip - POS systems are still closed and we are seeing trends to open up systems to marketing.

Ron - It's like cable industry right now. Be cautious because it is at a very early stage. I worked for the AOL and saw the wall come down. Are we going about personalization in the wrong way? How do you target people that just walked into the store that you've never met? Is there a way to do this in a customer friendly way? Real-time experience will produce better customer reaction.

Mike - Anonymous is being ripped away. Retailers know when you walk in a door and out. That's a session and can be paired with purchase.

Ron - What if we had a score to rate customers for merchants?

Varun - With geofencing there are a lot of things you can do.

Mod - Challenge for the merchant. How does merchant achieve scale?

Ron - How do I remove friction? How can data to improve relationship? How do you do it with existing infrastructure to not disrupt infrastructure?

Varun - Our merchants don't have access to distribution. Solution has to be easy for customers. It should be as simple as a hitting a button to drive more customers.

Chip - How do merchants deepen their relationships?

Mod - Where do you see companies making bets?

Mike - Grocery is looking at Mobile payments and mobile self checkout.

Chip - I would bet on mobile POS.

Varun - Never going to see one size all application. Having transactional layer enables horizontal & vertical.

Ron - It's like the gold rush. I'd rather be the grocer than the miner.

Varun - Data as a service, including weather.

Ron - Correlation does not necessarily drive causation.

Tuesday 2:50PM

Mobile Shopping's Best Kept secret: e-gifting

Mod - David Stone, CEO, Cashstar

Panel

Johanna Marcus - Director, Mobile & Digital Store Marketing, Sephora

Jill John - Director, Business Sales, Williams-Sonoma

Greg Consiglio - EVP & Head of Business Development, Viggle

Greg presents: We are a Social TV platform that rewards people for watching their favorite tv shows. You earn virtual currency and redeem via e-catalog. We launched this year and now have 1.2 million users.

Moderator, David Stone, CEO of Cashstar opened with own presentation:

"The gift card industry is a 110 billion dollar per year industry. There are 3 Waves of Gifting: plastic, online and mobile . . . 1 in 5 shoppers made a purchase with a mobile device . . . the Mobile Wallet is a mess. Passbook changes everything! Uses bar code, no chip, which means no mobile mess."

Moderation begins:

Mod - What in your retail environment, what is your experience with mobile shopping ?

Johanna - We are seeing mobile as opportunity to extend our stores into everyday shopping.

Jill - We like to provide lifestyle experience and are extending to mobile.

Mod - What role does e-gifting play in shopping and engagement?

Jill - E-gift cards have been very successful with scheduling birthday gifts.

Johanna - When we heard Passbook was coming, we made it a point to be part of it day one. You can schedule e-gifts to be sent via email. The recipient can add it via Passbook or print it out. We see a good percentage of people adding e-gift to Passbook.

Mod - What are the benefits of mobile wallets?

Greg - Less about a mobile wallet. More about offers.

Mod - Retailers what do you think about mobile wallets?

Jill - They are eventually going to be used for everything.

Joanna - Just replacing payment card is not enough.

? Jeff w/EDO - Is Passbook going to change everything? Why do I need Passbook?

Jill - Passbook is a good example. How many apps are you going to have in the phone? Consumers are not going adopt every app.

Greg Tarr - Cross Pacific Capital - How are you coordinating loyalty, mobile, coupons?

Jill - With 6 brands it does take coordination. We have central group.

Tuesday - 4:35PM

Keynote Presenter - Beth Horowitz - SVP Discover

"I was 18 years at MasterCard prior to Discover. In thinking about MONEY2020 event and making predictions of future . . . What will I be doing 8 years from now? What is the role of the network to enable? . . . I no longer use an alarm clock but my iPhone . . .

Creating this seamless environment:

1. Transaction processing

2. Standard and guidelines

3. Security and Risk Management

Networks have role to play at backend. How you going to scale?

We have to think differently and embrace new models but rely on existing infrastructure . . . CNP transactions, we must reevaluate. What are the pieces of data that prove the customer is in the store?

How can the networks evolve?

We've got the speed, we just need to become more agile. Our Discover marketing platform allows for security and marketing alerts. There is a way to share data so all win. It can be very powerful if we can leverage connectivity and security.

Standards

- global, ubiquitous, simple

- NFC, EMV and QR

To me it's about usability.

If we were to do it all over again we would not put data out there. It will take a while to set standards by how consumers will want to pay or use.

3 Key Takeaways

- Need to evolve new ideas

- We must maintain transcaction security

- Conventional got us here and non-conventional will take us the rest of the way

Lots of interesting quotes here from Beth. It seems they are walking a road of innovation. It will be interesting to see how CNP via mobile wallet with verified location and identity play out. Beth does seem to have a great focus here and gave and excellent vision and presentation of "A Day in the Life of Mobile Commerce in 2020."

Tuesday - 4PM Power Panel

MCX Overview & Strategy

Moderator - Dodd Roberts, MCX

Panel

Stephanie Swain, Senior Director, Best Buy Financial Services

Peter Nash, Assistant Treasurer, CVS Caremark

Mike Cook, Vice President & Assistant Treasurer, Walmart

Shelley Perelmuter, VP Customer Relationship Management, Gap

Mod - What's your view of mobile payments?

Stephanie - I see no standard.

Mike - We did not see any solutions in the market today that we wanted. The consistency across all channels will provide ubiquity.

Stephanie - MCX gave us the best opportunity to serve customers in the way they want to be served?

Mod - How are retailers getting along?

Peter - In 35 years I've never seen such alignment.

Shelly - The scale is the opportunity.

Mod - Solutions in market?

Mike - In mobile there is no such thing as CNP or CP. We knew how to make transactions more secure a long time ago, but now it is viable.

Mod - Concerns about porting transactions to mobile?

Peter - Protecting card data.

Mike - We hope to have deeper relationship with the consumer by engaging before, during and after transaction.

Stephanie - We look at the customer data we view as our most important info and work with it in the consumers best interest.

Mod - Is mobile payments adoption delayed by not investing in infrastructure?

Shelly - The challenge is managing the investment and maintaining consistency. We are very willing to invest. However, we invested millions in contactless a few years ago and now it is worthless.

Mike - We are not going to engage in several mobile wallets. What MCX invests in is our bet.

Mike - We have a vested interest in making this solution successful.

Peter - Our resources are not unlimited, specially with POS interaction and in store.

Mod - Consistency of experience, how does MCX address consistency and ubiquity?

Shelly - We envision that we will not prohibit the tender, but the means to transact will be consistent across MCX.

Mod - MCX attacking FI's?

Stephanie - We are bringing array of core competencies.

Mike - We plan on mobilizing our gift card.

Stephanie - We want make experience a good one.

Mike - Walmart app has voice controls for shopping list by aisle and product locator. The last thing we want is to have a consumer to open separate app to transact. The payment should be embedded.

Mod - Transaction security?

Shelly - Transaction security is paramount. It could be number one priority.

Mod - Will you engage with Apple once it has NFC?

Shelly - We are building flexibility into the platform to accommodate 3rd parties.

Shelly - You are not going to see us launch a coalition loyalty program.

Mike - I don't see EMV playing a role. To me it's replicating existing system out there.

Audience ? How do you plan to use data across MCX?

Answer by panel - Merchants control all data and will decide individually if they want to do co-marketing.

Jumio has developed technology, Net Verify, to capture, scan and validate credit cards and ID's using a phone or computer camera. I had the chance to watch the technology in action and it is pretty cool. In studying the behavior of thieves for years myself, I can appreciate this technology as it provides a barrier to theft. Thieves by nature will take the most easy route to commit theft. With this barrier up thieves are likely to go elsewhere to steal.

The technology is designed for white labeling and it's main purpose is to reduce fraud and save money for online businesses. VP of Business Development Sonny Singh stated "Here in the U.S. we have credit bureaus and a banking system which work to verify identity, but in many places in the world, there is no way to verify who people are. This is especially important with large ticket purchases."

The company, which has been covered by TechCrunch, USA Today and Forbes. Andreesseen Horowitz, Citi Ventures and Eduardo Saverin are investors in the company. Their clients consist of Travelocity, Western Union, Rideshare, Gyft and bitinstant.com.

I asked Sonny how much the service costs and what kind of revenues are they hitting? Sonny replied "We just launched a site and did 18,000 scans in the first two weeks. We charge $2 per scan." This is just an example provided by Sonny, for a single client, and not Jumio's total revenues.

Sonny went on to talk about their NetSwipe product which he says many mobile wallet vendors are using. He said the best use cases are for e-commerce, social commerce, oil companies, stock trading and money transmitters. Sonny provided me with a link to share of a company using their technology.