Our SuperCommerce Series

Copyright 2012. All rights reserved, Mobile Wallet Media, Inc. News & Opinion on the Future of Mobile Payments & Commerce!

Sponsor Spotlight Coming Soon! >>

About Mobile Wallet Media

Get your company

Embracing Innovation is Answer to Tech Disruption at the WSSA Conference

Search, Social or SuperCommerce?

The key to commerce shall be the seamless completion of the value and convenience chain for consumers and merchants alike.

How may Google, Facebook and First Data disrupt Daily Deals? Will EVOLUTION lead

to REVOLUTION? How about M&A?

Daily Deals Manifest Destiny

Can one live on deals alone?

Tour D' Mobile Payments

PayPal, Google Wallet, ISIS, Square & more. What are the barriers to adoption and how they may be overcome?

AUG

SEPT

SEPT

The Future of Money

Where will payments be in 2020? Will mobile over take cards & cash? Learn how a 'Secure, Social & Rewarding' wallet will disrupt it all?

Bridging the POS GAP

NFC is Tortoise and the 2D Bar Code is the

hare. Retailers, simplify the myriad of choices!

Learn how DISRUPTION is RIPE for 2013!

OCT

OCT

Greed is NOT GOOD!

Cause Commerce IS!

Cause Commerce can set you apart! Learn what it is, why it will soon be, non-optional, and how it will add to your Social Brand.

NOV

Loyalty LIKE Never Before!

NOV

Companies and leaders, to remain relevant and profitable, must embrace innovation or risk becoming irrelevant or extinct.

Top 5 Killers of Innovation!

HDTV - High Def. Total Vision Where are your Blind Spots?

Connect the dots! See the big picture!

If your Mobile Strategy is unclear, you may be

missing key pieces. Get a holistic perspective.

AUG

DEC

TM

The Western States Acquirers Conference delivered insights and direction for the payment industry to follow. Two of the general sessions were "Embracing Change; Staying Relevant in the Changing Payments

By Randy Smith,

Mobile Wallet Media

September 29, 2012

About Mobile Wallet Media

Mobile Wallet Media is a news media, analyst, marketing and consulting firm focused on the future of mobile: payments, marketing, loyalty, commerce, security, prepaid, virtual currency, daily deals and the convergence of them all with social and local. The Chief Editor, Randy Smith, was the primary founder, inventor and former CEO of MobilePayUSA, a TechCrunch Disrupt Startup Alley Winner.

The convergence of Social & Rewards is here!

Learn how Top of Mind & Automation will rule! Maximize, Mobilize & Unify Ads & ROI!

Mobile Wallet Media is a news media, analyst, marketing and consulting firm focused on the future of mobile: payments, commerce, daily deals, security, loyalty, marketing, prepaid cards, virtual currency and the convergence

of them all with social and local. Learn more

It seems like the overarching message being delivered here was, don't panic, but do take action now!

Attending diverse trade shows in this past year and past 15 years, I've come to hear the words 'Disruption' and 'Innovation' a lot. These two words, in 2012 have lead the pack for trendy words used in business and technology. The words address the issue of change and remaining 'relevant,' also another trendy word in our vocabulary today.

The word Disruption in Silicon Valley and the tech industry represents a method of being innovative by creatively solving problems or providing a solution that could be done in a much better, simpler, quicker or more cost-efficient way. Disruption is innovation and vice-versa. It is only when it is you that is being disrupted that it is viewed with disdain or threat. But this is business and competition and change is always the constant. To stick your head in the sand and think that things will remain the same as they have always been is strategy that will deliver your worst fears to become reality.

Innovation is offense. It is moving the ball forward and the best defense is a great offense. The SR-71 BlackBird was developed in the 1960's by Lockheed Corporation. It can fly as high an altitude as 100,000 feet with 3 times the speed of sound (3.5 Mach). It was in use by USAF for 40 years and was retired in 1998. It actually had no defensive weapons, but relied solely on it's speed, stealth and maneuverability to evade it's enemies. In all it's years of service it was never shot down. But even it was retired after 30+ years in service. Why? It was retired because the next generation of technology was ready to replace it. And now is the time that new innovation is replacing the status quo.

Landscape" and "Future of Acquiring . . . Will you Wipe Out or Catch the Big One?" The wake-up call to reality is ringing and it is time to answer the call. If you can't beat the join them, might provide the answer.

The era and strategy of stagnating change, by the incumbents is over. This may not have been an overt strategy and will perhaps prove to not have been the best one to embrace. The payments industry has enjoyed a 30+ year period of living in their silo and now is the time collaborate and innovate. It's time to reinvent or risk being replaced. It may even be the time to choose retirement.

While it is true that the payments industry is being disrupted, this does not mean it is too late to be innovative and even partner with the tech companies that are currently out innovating them at their own game.

The subject of the day at the conference was: What can and should the ISOs and payment companies do in order to remain profitable and relevant in coming months and years? Also what have the 'Tech Titans' been doing that works that can be implemented and executed by payments companies & ISOs?

Key Quotes from Speakers

Greg Cohen of Verifone Commerce Solutions stated "What the new world has shown us is that customer experience is everything."

Kim Fitzsimmons, CEO of Cynergy Data stated " Google developed their wallet around what customers wanted."

Todd Ablowitz of Double Diamond Consulting stated "Jack Dorsey had to fight investors, directors and his team to get them to do what they did."

Looks like his persistence paid off. Even though Square is not profitable, and may never be with it's current revenue model, they like Sean Parker with Napster in the late 90's, changed their industries forever.

Greg Cohen also stated "Look at biz as just 'Commerce,' not just payments, retail or e-commerce."

Eric Barth of TSYS stated "Figure out what you are good at, pick a few verticals and go after them."

Kim Fitzsimmons stated "Pick your vertical and do something that makes you different."

Eric Barth also stated "Honest self-assessment is always good."

Todd Ablowitz stated "Square got away with some things possibly because Visa had an investment in them and the networks wanted to capture the 'Craigslist' transactions."

Greg Cohen stated "It's a new game since the networks went public."

Kirk Mann of First American Payment Systems stated "If you don't know exactly what the customer needs, you are toast . . . You need to map our your the value chain of your organization to discover where you may add value."

Stacey Tappin of Apriva added "The vending market is a wide open market for card acceptance. Only 3.7% of vending machines accept cards out of the 5.4 million machines in the field . . . We and a few other service providers in the space have negotiated a rate of 2% plus 2 cents per transaction."

Donna Embry, SVP of Payment Alliance International stated "It's time for Revolution and Evolution. It is the best of times and the worst of times, but right now is the beginning of the best of times. Riding the wave of 'Social and Mobile' is what will provide the upswing. Social Media is the biggest Game-Changer in the history of payments. Consumers will drive change and to do well, companies must align themselves with consumer trends. There will be the Betamax and VHS (for mobile wallet/payment standards) that rise to the top."

Jeffrey went on to point out that though you may face life-threatening or in this case industry- threatening circumstances, that when you are in 'Good Company,' everything will be fine.

Albeit, this was a great story with a solid lesson to be learned, I think it could be an even more powerful vision of what is needed by not just the payments industry, but any industry that faces disruption and change. Yes, working together within the industry makes sense to help each other out, but much more is needed to safely make the ascent to the top. The two divers that need to share air are from both the payments industry and the tech industry. Or perhaps the air supply is from a maverick innovator or someone that understands both sides of the fence?

The companies from each side that do the best job partnering with each other to engage innovation, will be the ones that safely transition to the top. Jacques reaction of PANIC at the DISRUPTION OF HIS AIR SUPPLY, almost killed him. No one would dispute that Jacques was an experienced veteran and innovator in his industry. However, if you react like Jacques, it could kill your business. Seek a new air supply from those that are offering or risk death of your business' revenues and relevance.

Collaboration is now a requirement, not an option. Now is not the time to panic under pressure, but to remain calm and look for new sources of revenue. ISOs should seriously consider entirely reinventing themselves and possibly sell portfolios to fund your new ventures or even your retirement.

PayPal's Matthew Watts was asked about their openness to partner with ISO's. His response "PayPal is very open to partnering with ISO's."

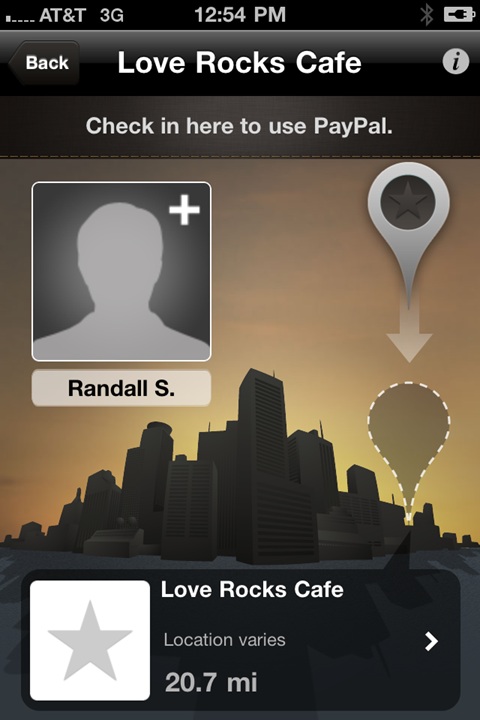

Matt Watts of PayPal stated "We are a Digital Wallet at the core. We have 113 million active users and 9 million merchants. There are 103 million smartphone users in the U.S.. 79% of smartphone users are interested in using mobile coupons. Using offers to drive consumers to the store is important. Delivering and 'End-to-End Value-Chain is Key. Acquisitions of Milo, Bill Me Later, Red Laser and Where are services that will enable us to deliver this value chain . . . Shipping and billing data do not need to be entered by the consumer as they are stored by the wallet . . . There is soon to be the opportunity for ISO's to sell PayPal (just like Discover, Amex, Visa and Mastercard). We will soon have a 'Buy-Rate,' allowing ISO's to share in revenues."

Paul Martaus of Martaus & Associates gave the entire room a wake up call and delivered, in a nice way, a warning that change and disruption is coming and to act accordingly. He shared "Bar codes may be used to accept payments through Apple and this means that though the networks will get paid, you will not. Merchant's will soon be 100% responsible for mag-stripe transactions."

The closing keynote speaker at the event, Jeffrey Hayzlett, author of the book "Running the Gauntlet" and former executive at Kodak, told a story of an interview he conducted with Jacques Cousteau, the famous diver and underwater explorer and innovator. Jacques told Jeffrey a story how one time he was exploring a cave 140-feet deep. Upon exit of the cave his air tube was ripped open. Jacques began to panic. He began his ascent to the surface. He did so even knowing that surfacing too fast at that level would give him bends, which could lead to death. Just before he began his summit, a co-diver grabbed his ankle and handed him his oxygen mouth piece. The two slowly surfaced, safely to the top.