Copyright 2012. All rights reserved, Mobile Wallet Media, Inc. News & Opinion on the Future of Mobile Payments & Commerce!

Sponsor Spotlight Coming Soon! >>

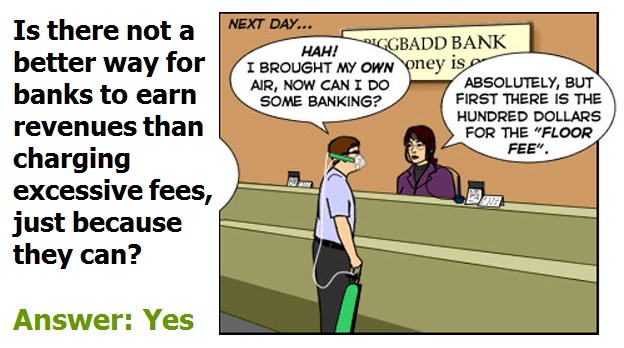

Bank Fee Sting is a Buzzing in DC! Is there a Better Way to Earn Revenues?

By Randy Smith,

Mobile Wallet Media

April 24, 2013

About Mobile Wallet Media

Mobile Wallet Media is a news media, analyst, marketing and consulting firm focused on the future of mobile: payments, marketing, loyalty commerce, security, prepaid, virtual currency, daily deals and the convergence of them all with social and local. The Chief Editor, Randy Smith, was the primary founder, inventor and former CEO of MobilePayUSA, a TechCrunch Disrupt Startup Alley Winner.

Regulation is a check and balance to deter unjust acts against consumers or citizens. Corporations and banks do whatever they can to meet or exceed revenue and profit expectations, in any legal way they are able. This is capitalism and compliance departments are dedicated to walking this line. But are not banks supposed to be our TRUSTED agents of our financial services?

Industries embracing innovation & integrity may operate with less regulation.

How Much Does it Cost to Process a Bounced Check?

The cost of a returned check to a bank may cost a dollar or less. Some estimate that with current tech infrastructure it may cost only a penny to process a returned check. Here's a quote from an article by Business Insider:

"Banks may mark up processing charges by as much as 470,000 percent, according to author David Cay Johnson, who discusses various forms of price gouging in his new book, The Fine Print: How Big Companies Use "Plain English" To Rob You Blind: "Back in the late 1970s, when checks were still processed by a person and a machine rather than digitally, Crocker Bank (now part of Wells Fargo) was forced to reveal in a California court case that its cost was thirty cents. At that time, the bank was charging customers $6 for bounced checks, a markup of 2,000 percent. The California Supreme Court held that charging twenty times the cost was not necessarily unconscionable. Adjusted for inflation, that $6 fee would now be $21, less than half was BofA charges. What are today's costs for processing a bounced check? B of A won't tell customers, but research papers on costs in the digital era suggest it could be less than a penny, making the markup by BofA in the neighborhood of 470,000 percent."

Why Not Just Decline ALL Transactions When Funds are Insufficient?

An article posted by NBC News states "The bank customers in this survey overwhelmingly (75 percent) said they preferred to have their transaction declined if they had insufficient funds, rather than have it processed for a $35 fee. The Pew study also makes it clear that people don’t like to be hit with surprise overdraft fees. More than 60 percent of those who had paid an overdraft fee said this service hurts more than helps. About a third of those surveyed said they had closed a checking account because of such a fee."

When there are insufficient funds, why not give customers the option to have all transactions declined, vs. overdraft? Is this technically feasible for all types of transactions? Can it all be automated for every type of transaction? The answer is YES to both questions. If automated the cost would drop dramatically for processing any NSF transaction. Why don't banks offer this? Why don't they just solve the problem? Because they make a lot of money from it and if they solve it, they are losing a revenue stream. Well, welcome to 2013! We live in a innovate or die or be regulated world.

The blow back of checks bouncing is the merchant pays the price. I have no real problem with this. Merchants can make a choice to accept a check from a customer or not and tap services to screen for bad check writers or available funds, they may use a check guarantee service or a service that recaptures funds on bad checks. However, at the end of the day, this does not account for check fraud.

The problem is checks and decoupled debit, as neither provide real-time locking in or verification of funds as do gift, prepaid, pin debit or credit card transactions. Decoupled debit, like that used at Target will approve transactions without the funds from a checking account being set aside instantly. Consumers with low balances that don't balance their checking account very closely can easily trigger overdraft coverage as the funds are debited from the checking account 24-72 hours after the purchase.

Why Shoot the Good Guys? Banks are Loading the Gun To Be Fired!

Now, I understand the economic rationality here in charging a flat $35 fee for any NSF or Overdraft coverage provided. That does not mean I agree with this rationale or buy into it.

ChexSystems keeps records about people who have “abused” or mismanaged a deposit account. In other words, they have a list of people who bounce checks or owe a bank some money.

If you bounce checks, your bank may report you and your activity to ChexSystems. ChexSystems then shares that information with other institutions that ask about you. It’s kind of like an agreement among the banks to help each other avoid risky customers.

Why do banks provide overdraft coverage? Because they make a boat load of money from it. Thirty-two billion in fees in 2013.

There is no excuse for NSF or overdraft fees for online or mobile bill pay. Rather than paying the bill, the bank should just not execute payments and then notify the customer the bill was not paid.

Overdraft fees charged are often excessive. I was once charged $175 for a string of 5 overdraft fees of $35. And worse yet my online banking system was programmed to allow for me to execute this even though I would have shortage of funds. The funds were short for all of 1-2 seconds or minutes as the deposits were credited soon after midnight. I spoke to my bank and though it took a few conversations to get all funds credited back, they did reverse the fees.

This is only a single example of NSF fees, but it clearly shows that banks are willing and set up to make a quick and easy buck any way they can so long as it is legal or are too lazy to look out for the best interest of their customers. Sometimes laws do not yet exist that ensure fairness towards the consumer.

Can you imagine if what happened to me happened to a single mother of three kids with no savings and no credit cards? First off she may have settled with an offer of 50% reduction in fees that I was offered. Second, if she did then her kids might have to go hungry, other bills might go unpaid or she might get a payday loan, which charge the equivalent of a 100-200% annual interest rate. Even here is an opportunity to provide a reasonable cost option to meet short-term cash flow for their customers. Instead banks have set things up to induce fees. They collect their spoils without grace or regard for the circumstances of their customer.

I understand in both cases the fees may be high for reasons of covering fraud losses, but they are too exorbitant. There is much more that can be done to prevent fraud and better ways to generate revenues than just charging excessive fees.

It's almost as if the banks are setting up 'Speed Traps' to capture these huge fees. Banks make it difficult to opt-out of Overdraft Protection plans. Why can't they be as easily opted out of as with email newsletters? Why is there not a one-click button online and in mobile apps to turn on and off enrollment in overdraft programs? Because the banks make a ton of money from them!

And yet another example of high fees are credit card late fees. The window from the time a consumer receives their bill to the time they need to place a check in the mail or use bill pay is sometimes less than a week. A $40 fee for being a few days late with a $40 minimum payment on a $1,000 balance is kind of excessive don't you think? Well, most banks offer a one-time removal of this fee, but often they request you call back to request the fee removal once the next statement is issued. How many people do you think forget to call back? We live busier lives than ever and banks take advantage of this.

These 'speed traps' banks have erected are alluded to in an article by the Huffington Post:

"'Consumers might be trying to hide from the banks, but the banks keep coming up with creative ways to pick their pockets,' said Ed Mierzwinski, the consumer program director at the public advocacy group U.S. PIRG . . . Some banks now routinely change the chronological order of consumer transactions, putting larger purchases first, so that account holders sometimes find themselves paying multiple overdraft fees even if they exceeded their account balance only once. (The biggest banks charge a fee of $35 for each overdraft, on average.) Some institutions have raised the penalties on bounced checks to scare consumers into opting into overdraft protection . . . Instead, banks are increasingly going into the business of providing high-priced short-term loans to consumers . . . Claes Bell, a senior banking analyst at BankRate.com, said 'It sounds reasonable on its face, but when you think about the fact they’re extending those loans for only two weeks or so, you realize they’re charging a ridiculous interest rates," he said. 'They’re payday loans, except they don’t call them that.'"

Why Not Offer a 2, 5, or 10-Day Grace Period Before Applying Big Fee?

So the real problem with charging excessive fees is by not showing some grace to customers whom were just a bit too busy, absent minded or had a very temporary cash flow problem. Charging no fee or a small but reasonable fee like a flat $2-$5 fee for up to a 2-5-day grace period and a larger fee of up to $35 if they do not add sufficient funds to their account to cover NSF or late card payments, is a more reasonable, fair and very likely, the most profitable way for banks to operate without making any major infrastructure costs. It actually builds a bridge of good-will and revenue that may not only surpass current revenue, but may also lead to repairing the distrust and bad opinion towards banks.

Banks charging such excessive fees is like the US military having a policy of attack with big conventional bombs first without giving ample warning and grace period, warning shots or enacting economic sanctions. Rather than just capture fees, banks need to innovate and infuse grace and new services to re-brand their image. They need to show they care with more than just words, but with actions that display it. The bank that leads with the campaign products and one-minute commercial as follows is the one that may capture huge market share:

"Consumer Trust Bank introduces Banking Reinvented! You deserve the right to not have your bank gouge you with excessive fees just because you got too busy, were a bit absent minded or had a temporary shortage of cash? Introducing, the ‘Free 48-Hour Grace Period Overdraft Protection Plan.’ If you add sufficient funds to your account to cover a check, debit or bill payment within 2-days from time of email notice of non-sufficient funds, you will not be charged a fee. We also make it simple for you to turn on and off your overdraft protection with a simple one-click button online or via our mobile app. Also say goodbye to fraudulent transactions! We enable you to turn on and off any of your cards or accounts with us via a one-click button online, or by using our mobile app. We also believe in making saving, while shopping, more simple! Use your Consumer Trust Bank card or our mobile wallet app to instantly save or earn 1-50% cash back rewards! We believe in you and value your time and money. Consumer Trust Bank - Banking Reinvented."

The turning the money your money on and off idea is mine and is blueprinted at MyCreditVault.com. This idea could, with some programming, could be offered by any bank with resources, but would be best if implemented by all banks. Networks could also differentiate themselves by providing this service for their member banks and consumers. This service would surely drive customers to the bank and enhance loyalty to use such a card. However, this does not solve the problem of ID theft accomplished through the fraudulent issuing of a credit file by a credit bureau. MyCreditVault's solution would solve this. This is a far superior solution than credit monitoring or credit alerts. If one controls the issuing of their credit file, then ID theft here would not happen. Banks could sell MyCreditVault service to their customers or provide along with a $10 - $15 monthly service fee for a premium checking service account. Banks would also make the perfect fit to authenticate and activate customers for this service.

Mobile Deposit, Advanced Access to Funds Is now a Revenue Source

An article by American Banker states:

"Regions Bank on Friday became the latest institution to roll out mobile deposit capture, but what may be most notable about the service is that it's charging customers a fee for using it.

Fees range from 50 cents for an option that makes funds available in two business days to 3% of the amount of the check for immediate access. A third choice that costs $3 lets consumers cover charges against their accounts the same business day and tap the funds via their debit card or at automated teller machines on the business day that follows . . .

The move comes as a growing number of banks rethink their decision to not charge for mobile remote deposit capture. Though U.S. Bancorp (USB) announced two years ago it would charge for the service, most banks offer it as a value-add that spurs use of other services . . .

Peters says Regions knows some consumers may recoil at the suggestion they should pay anything for the service, but says the bank is betting most customers will compare the fee with the cost of driving to a branch or ATM."

My opinion here is that if consumers are given the option to gain access to funds earlier for a fee and the consumer clearly understands this, then so be it. Correct me if I'm wrong here, but does not mobile deposit save banks money on processing vs. in branch deposits?

I'm a believer that this is a loss leader or even a way to earn revenue by pushing offers and getting a bonus reward if a consumer uses mobile deposit and redeems the offer. This is another consumer interaction that may be a good time to sell or make offers to customers. Banks should use this as an onramp to more profitable services. Banks that embrace a low or no fee policy for mobile deposit are sure to gain more customers and more likely to win their business on loans and deposits, which should generate a vast majority of a banks income. For success tomorrow banks need to adopt innovation that incorporates merchant marketing revenues. This will soon no longer be an option to compete and for time being will set them apart from the rest. Those that take the lead early here will be assured to gain larger revenues later.

Embrace New Innovative Revenue Models or Regulation will Ensue

Banks need to do away with their toll-road, one fee fits all mentality. Banks need to tear down the toll-road mentality and build revenue models that form a more perfect union with their merchant and consumer customers. Ally Bank, Amex's Bluebird and Discover's new 'IT Card' all seem to be heading down this road.

Banks need to adopt new revenue streams that save money and time for their customers, vs. with excessive overdraft and late fees that take advantage of a lack of money and time of their customers.

BofA last year launched BankAmeriDeals which connects their retail customers via merchant offers. This is an early forerunner or blueprint of the future of adding a service where the bank earns revenue for pushing merchant offers to consumers. Cardlytics is one of the early innovators in providing this service for banks. Banks can earn 2-20 fold over interchange revenues via transactional affiliate or pay-per-sale programs or by offering Daily Deals. This model will eventually evolve to the Mobile/Digital wallet, with savings or rewards being issued and redeemed directly through it.

Google may get paid 80 cents for a click-thru, but could get paid $8 if they were able to prove they drove the customer to make a purchase. Transactional revenues tied to marketing is the big wave that banks must ride into the future. Banks need to start embracing this innovation or become extinct.

Charging excessive fees just because banks can do so, does not mean it is the right, smart or most profitable way for banks to do business. Taking advantage of the poor cash flow of customers draws the ire of consumers, consumer groups and the media and leads to regulation and loss of reputation.

Getting more creative by embracing innovative ways to produce revenue than just charging fees, is the way forward. Can it replace the 32 billion in fees banks charged for overdraft coverage in 2012 and the estimated $6.6 billion/year in revenues banks lost from debit card processing, post-Durbin amendment? The retail ad and marketing industry is a trillion dollar a year industry. It would only require banks to capture only a small portion of this market to replace much or all of their fee income. Banks have the opportunity here to rebuild the trust that has clearly been broken. Embracing innovation can fix it.

IF YOU FORGOT WHAT INNOVATION LOOKS LIKE

WATCH IPHONE'S FIRST COMMERCIAL BELOW . . .

Media Partners

Discussing the Future

of Mobile Commerce!

The opportunity, the huge, gigantic opportunity and necessity exists for banks and big retailers to form a more perfect union with their customers. The way forward is thru providing services that enhance customer

relationships, over wielding the power to charge excessive fees. Banks that step up to take the higher road, will end up on top of the market. The rest will eventually have to follow, but suffer massive loss of customers and reputation. Banks that take the lead by embracing innovative ways to earn revenues, will prosper greatly. I'll start by identifying current legislation and fees, the problem with charging excessive fees and finish with sharing potential solutions.

Image source: jetsam-adrift.blogspot.com

The Overdraft Protection Act

A recent article by American Banker highlights the recently drafted bill:

"House Democrats introduced a bill Wednesday designed to address concerns about the fees banks charge consumers when a checking account is overdrawn.

The Overdraft Protection Act, co-sponsored by 46 lawmakers including the House Financial Services Committee's two top Democrats, Reps. Maxine Waters of California and Carolyn Maloney of New York, would codify a 2010 Federal Reserve Board rule requiring consumers to "opt in" for overdraft protection. It would also cap the number of fees institutions can charge an individual for overdrafts to one per month and six per year, and requires those fees to be "reasonable and proportional" to the amount of the overdraft.

In addition, the legislation would prohibit the ordering of debit charges from "high to low," a practice that has garnered numerous class action lawsuits, and directs the Consumer Financial Protection Bureau to study the use of overdraft fees with prepaid cards and potentially extend the bill's provisions to those cards if needed."

The Biggest Problem with Overdraft Coverage is a Lack of Awareness

NBC News posted an article summarizing findings that highlight the problem of the lack of consumer awareness of overdraft plans, their existence and how they work. The article shares:

"According to a new study by the Pew Charitable Trusts, more than half the people who overdraw did not know they had signed up for overdraft coverage that would result in a fee. More than one-third of the respondents surveyed did not know their bank offered overdraft coverage until they incurred a penalty.

“Many people didn't feel they fully understood the bank's policies,” says Susan Weinstock, director of Pew’s Safe Checking in the Electronic Age Project. “Forty-three percent said they didn’t think their bank’s policies were very clear about overdrafts.”

Fees of up to Thousands/Year Affect Low-Income Earners the Most

This article by the Consumer Financial Protection Bureau launches inquiry into overdraft practices states:

"According to various industry sources, the average overdraft fee ranged from $30-$35 in 2011 and has increased by 17 percent over the past five years. A study by the Federal Deposit Insurance Corporation published in 2008 found that consumers who overdrew 20 or more times per year paid an average of $1,610 in overdraft fees annually.

The Bureau is revisiting the 2008 FDIC study that found that 9 percent of checking account customers bear about 84 percent of overdraft fees. Evidence suggests that overdraft programs disproportionately impact low-income and young consumers. According to this study, 46.4 percent of young adult account holders incurred overdraft fees, and of those, 15 percent recorded more than ten overdrafts in one year."

Prepaid cards, adopted mostly by the young and low-income earners whom can least afford fees, are actively still assessing fees for nearly everything. American Banker reports "Newer prepaid cards from JPMorgan Chase (JPM) and American Express (AXP) feature more transparent pricing than many of their older peers. But the recent arrivals have yet to make a major impact on the overall prepaid market's pricing structure, a new survey suggests."

PYNNTS.com summarizes the Bankrate.com findings:

"Bankrate's 2013 Prepaid Debit Cards Survey compared 24 prepaid cards based on the fees they charge consumers and the results are not much different from the company's 2012 prepaid survey.

Bankrate has previously reported that 72 percent of credit unions and 39 percent of banks offer standalone free checking accounts.

Monthly Service Fees

Fifteen of the 24 cards (63 percent) charge a monthly service fee ranging from $3.00 to $9.95.

Activation Fees

Two-thirds of the cards are free of activation fees if purchased online. Fifty-four percent can be purchased in-person without an activation fee.

The activation fees range from $2.99 to $14.95."

image source:

$$

32 Billion in Overdraft Fees in 2012!

From a Forbes article: "The Bureau is revisiting the 2008 FDIC study that found that 9 percent of checking account customers bear about 84 percent of overdraft fees. Evidence suggests that overdraft programs disproportionately impact low-income and young consumers."

Our SuperCommerce Series

Search, Social or SuperCommerce?

The key to commerce shall be the seamless completion of the value and convenience chain for consumers and merchants alike.

How may Google, Facebook and First Data disrupt Daily Deals? Will EVOLUTION lead

to REVOLUTION? How about M&A?

Daily Deals Manifest Destiny

Can one live on deals alone?

Tour D' Mobile Payments

PayPal, Google Wallet, ISIS, Square & more. What are the barriers to adoption and how they may be overcome?

AUG

SEPT

SEPT

The Future of Money

Where will payments be in 2020? Will mobile over take cards & cash? Learn how a 'Secure, Social & Rewarding' wallet will disrupt it all?

Bridging the POS GAP

NFC is Tortoise and the 2D Bar Code is the

hare. Retailers, simplify the myriad of choices!

Learn how DISRUPTION is RIPE for 2013!

OCT

OCT

Greed is NOT GOOD!

Cause Commerce IS!

Cause Commerce can set you apart! Learn what it is, why it will soon be, non-optional, and how it will add to your Social Brand.

NOV

Loyalty LIKE Never Before!

The convergence of Social & Rewards is here!

Learn how Top of Mind & Automation will rule! Maximize, Mobilize & Unify Ads & ROI!

NOV

Companies and leaders, to remain relevant and profitable, must embrace innovation or risk becoming irrelevant or extinct.

Top 5 Killers of Innovation!

HDTV - High Def. Total Vision Where are your Blind Spots?

Connect the dots! See the big picture!

If your Mobile Strategy is unclear, you may be

missing key pieces. Get a holistic perspective.

AUG

DEC

TM

New Series for 2013

The 'Disruptive Innovation Meteor' named MOBILE has struck the world's of retail payments, banking and marketing. Firms wanting to survive, compete and win in this new environment must adapt by embracing disruptive innovation or risk becoming irrelevant or extinct. Read story

IF YOU FORGOT WHAT INNOVATION LOOKS LIKE

WATCH IPHONE'S FIRST COMMERCIAL BELOW . . .

Disruptive Innovation and Dysfunctional Dinosaurs

image source: abcnews.go.com

Use discount code “WALLET” to receive $200 off registration.